The limits on your account depend on what kind of account you have. All new members start out with an Unverified account. Members may then upgrade to a Verified account which offers more features and benefits, including higher limits.

What are Unverified accounts?

All members start with an Unverified account when they first sign up for a NETELLER Account. An Unverified account is a basic entry level NETELLER Account. Unverified accounts allow you to quickly deposit and transfer funds to any online merchant or to friends and family. However, to take full advantage of all NETELLER services, including higher limits, the ability to withdraw, the Net+ Prepaid MasterCard® and much more, you will need to verify your account.

While you have an Unverified account, you have a maximum lifetime funding limit of 2,850 USD. This means that the sum of all credits into your account cannot exceed 2,850 USD – including any deposits, transfers from other websites, or transfers from friends. Our system will let you exceed this lifetime funding limit, but your account will be immediately frozen and you will be required to verify your account in order to access those funds.

In addition to the cumulative lifetime funding limit, an Unverified account holder also has lifetime limits for each of various types of transactions, including:

A maximum of 500 USD for deposits using validated credit or debit cards. This limit is cumulative across all card types; for example, you can do a deposit of 100 USD on your Visa Electron card, but will then have only 400 USD left available to deposit with your MasterCard credit card.

You are also limited to using a maximum of three credit card numbers and three debit card numbers when you have an Unverified account.

Using the International Bank Transfer or Local Bank Deposit options, as well as when transferring, Unverified members are limited to a per transaction limit of 1,100 USD. Again, you are able to deposit more than this amount, but your account will be immediately frozen and you will need to verify your account to access those funds.

Unverified members are limited to one trial use of the NETELLER Money Transfer system. Using this trial use, you can either send a maximum of 100 USD to a friend, or receive a maximum of 100 USD from a friend.

In addition, most other deposit options have a lifetime funding limit for that specific deposit option. In these cases, you cannot exceed the lifetime funding limit for that deposit option, but you will be able to continue using other deposit options in your NETELLER Account until you have reached your total 2,850 cumulative funding limit. Check out our FAQs on each deposit option for more information about the lifetime limit for each option.

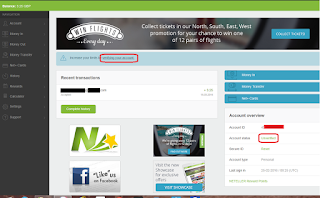

To view the minimum and maximum limits within your account, simply roll your mouse cursor over any green question mark within your NETELLER Account.

To increase your limits, withdraw funds, and take full advantage of your NETELLER Account, simply verify your account for free.

Why do I need to verify my account?

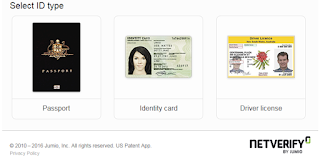

NETELLER is authorised and regulated by the Financial Conduct Authority. As a regulated financial institution, we need to know who is using our system. When you verify your account, we ask you to provide proof of identification and proof of address. This makes things more secure for all members by helping to prevent fraud or identity theft.

What are Verified accounts?

Once your account has been verified, you are provided with much higher limits, as well as access to withdraw funds.

Using a credit or debit card, or using a Get2Pay prepaid card, you may deposit 4,000 USD every 30 days, or even higher depending on your country of residence.

Using the PaySafeCard deposit option, you can deposit up to 5,000 USD every 30 days.

Using your bank account, you may deposit up to 400,000 USD monthly through the Local Bank Deposit or International Bank Transfer options.

Using most other deposit options, you can deposit up to 58,330 USD every 30 days. Please check out our detailed FAQs for each deposit option to learn more about your per transaction, daily, weekly, and monthly limits in all applicable currencies.

Using NETELLER Money Transfer, you may transfer up to 5,000 USD per transaction, with higher daily, weekly, and monthly limits. Limits may be lower if the person you are sending money to is still unverified.

When transferring to and from a merchant, you may transfer 50,000 USD per single transaction. There are no limits to the amount of transactions you can make in a day.

With a Verified account you also gain access to withdrawal options:

When withdrawing by Member Wire, you may withdraw up to 100,000 USD per 24 hours to your bank account. Using the Bank Transfer Withdrawal option, you can withdraw up to 1,152,700 USD each month directly to your bank account. Note that these two options are not available to all members; please click on the links above to see more detail.

When withdrawing by cheque, your limits depend on your country of residence. You can withdraw up to 19,200 per day at the minimum, and up to 100,000 USD per transaction in some countries.

When withdrawing by the Net+ Prepaid MasterCard®, you may withdraw up to 1000 USD in cash per day, make purchases of up to 3000 USD per day, or shop online using the Net+ Virtual Prepaid MasterCard® for up to 7000 USD per day. Learn more about Net+ limits in all supported currencies.

How can I increase my account limits?

After your account is verified, your limits will remain the same unless you qualify for our VIP program. Most VIP members have the same limits as verified members, but may request higher limits for credit, debit, and Get2Pay card deposits, or for Bank Transfer withdrawals. Requests to raise limits are reviewed on a case-by-case basis.

*Limits change based on each account, specific transaction types, and region. These are generic limits, please sign in to your NETELLER Account to review your own specific limits